What is an Investment Company?

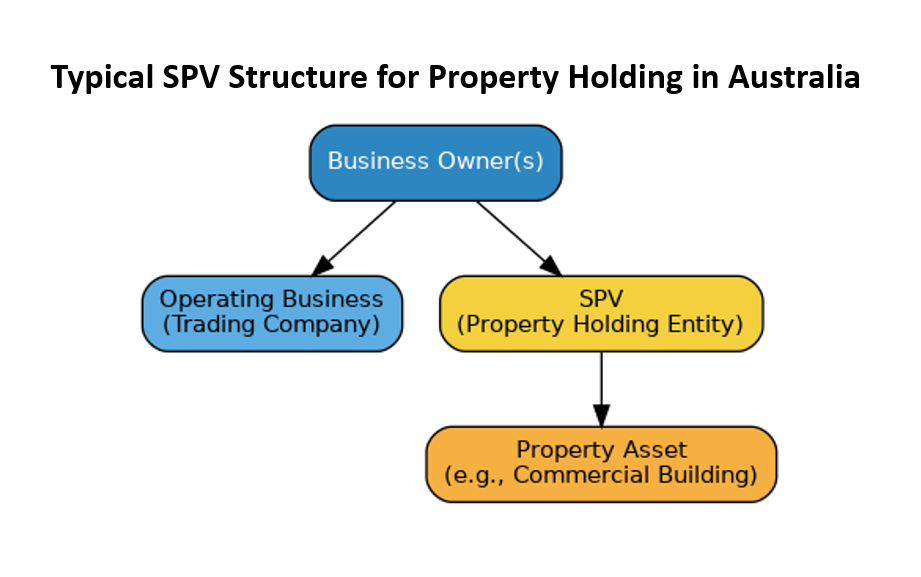

An investment company is a Special Purpose Vehicle. (SPV). An SPV is usually a separate legal entity (often a company or sometimes a trust) created to own a particular asset or group of assets, such as a commercial property, investment property, or development site and to ring-fence that asset from the operating business.

Why would you need one?

· Asset Protection – If the trading business gets sued or goes under, the property in the SPV isn’t directly exposed, because it’s legally owned by a different entity.

· Financing – Lenders like the clarity of a “clean” entity that only holds the property and doesn’t have the risk profile of a trading business.

· Tax Planning – Income and expenses from the asset can be isolated, sometimes making it easier to distribute profits or manage CGT later.

· Partnership Clarity – If multiple parties are buying a property together, the SPV can clearly show ownership stakes and limit disputes.

· Project-Specific Risk – In property development, the SPV holds only that one project. When the project finishes, the SPV can be wound up, keeping liabilities from spilling over to other ventures.

The key point: an SPV isn’t some exotic structure it’s just a dedicated company or trust with a narrow, defined purpose. The “special purpose” is whatever the asset or project is.

How an SPV Can Benefit a Business Owner or High Net Wealth Individual

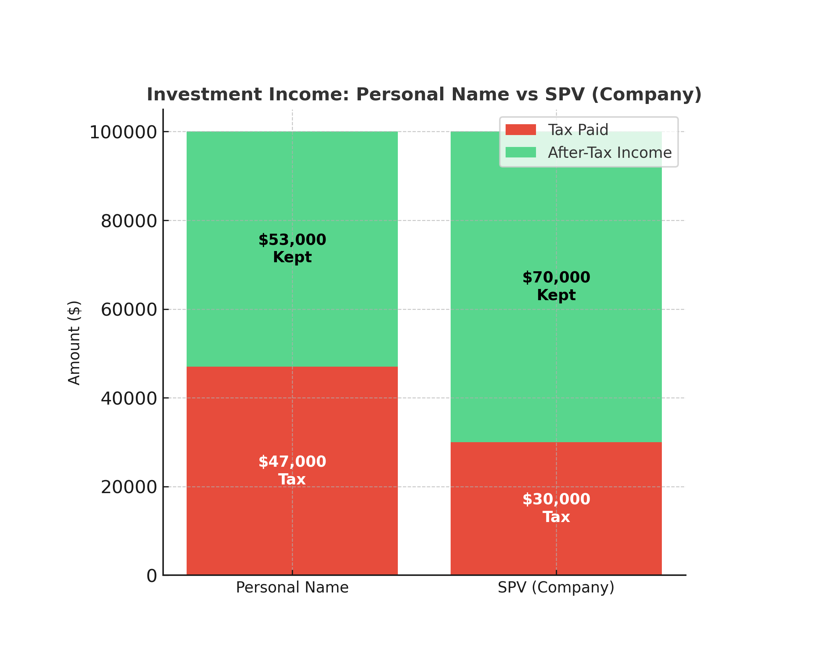

1. Lower Tax on Investment Income

If you hold the asset in your personal name, you will be subject to additional tax on any income that is derived from the asset at your marginal tax bracket. If you are already earning over $190,000 per year your tax rate is 47% on any additional income.

· $100,000 investment income → $47,000 tax at 47%

· You keep $53,000 after tax

If you hold the asset inside an SPV (company):

· $100,000 investment income → $30,000 tax at 30%

· You keep $70,000 inside the SPV after tax

· That’s $17,000 more retained each year for reinvestment

2. Compounding Inside the SPV

Because the SPV keeps more after-tax profit, you can reinvest that extra capital to compound your wealth.

· $70,000 reinvested at 8% p.a. → grows much faster than $53,000 reinvested personally. The difference is well over $250,000 in a 10-year period. But the biggest kicker is you have the ability in a SPV to distribute that income at a later stage with a franking credit.

What is a Franking Credit?

A franking credit is a tax credit attached to dividends paid by Australian companies to their shareholders. When a company earns profit, it pays company tax (usually 30%) before it can distribute dividends. Introduced in 1987 by Treasurer Paul Keating under the Hawke Government. Its purpose is to stop double taxation of company profits and encourage investment in Australian companies.

· Without franking credits, shareholders would pay tax again on the same income, causing double taxation.

· Franking credits mean you only pay tax once, any tax already paid by the company is credited to you when you receive the dividend.

Read more about Franking Credits here.

Why This Matters for High Net Wealth Individuals

If you’re in the highest marginal tax bracket (47%), any income above $190,000 personally attracts $0.47 in tax per dollar. If you earn investment income through an SPV, you first pay 30% company tax, which is far lower, and let the profits grow inside the SPV.

Over 10 years, compounding profits inside the SPV could build up large, retained earnings plus franking credits.

· Let’s say you’ve accumulated $1,000,000 in retained profits inside the SPV.

· At a 30% company tax rate, that means $300,000 in franking credits have been banked.

The Distribution Example

You now decide to distribute $100,000 from the SPV as a fully franked dividend. You’ve stopped working and now want to live on $100,000 per annum.

Step 1: Grossing up the dividend:

· A $100,000 cash dividend comes with franking credits.

· To work out the “grossed-up” income, you divide the cash dividend by (1 – company tax rate).

· $100,000 ÷ 0.70 = $142,857 grossed-up income

This $142,857 is what you’re deemed to have earned for tax purposes, $100,000 in cash plus $42,857 in franking credits.

Step 2: Calculating total tax payable:

· $142,857 x Marginal Tax = $37,052 total tax payable

Step 3: Subtract the franking credit:

· You already have $42,857 in franking credits from company tax paid earlier.

· $37,052 total tax payable – $42,857 franking credit = Tax refund of $5,805

Step 4: Effective tax rate on the cash received:

· You received $100,000 cash, and received a tax refund of $5,805

· Effective personal tax = 0%

Why It’s Powerful Over Time

For a high net wealth individual / Business owner, that’s a massive compounding advantage and when you finally pay yourself, the franking credits ensure you’re only paying the difference between the company tax rate and your personal rate (if any).

To chat more about strategies to help manage tax within your business, book in for a free 15 Minute Discovery Call.