- Who this is for: Business owners, professionals with variable income, and high‑net‑worth families who want asset protection, tax‑flexible income distribution, and clean succession.

- What a family trust does: It lets a trustee hold assets for a class of beneficiaries, with wide discretion to distribute income/capital each year.

- Why it helps: Direct profits to the right people at the right time; ring‑fence assets from personal risks; create succession that outlives you.

- Non‑negotiables: Use a corporate trustee, lock in your appointor/successor, get the schedule right, and understand Div 7A/UPE and resettlement risks.

General information only. This is not personal financial or legal advice. Speak with your accountant/solicitor before acting.

What is a Family (Discretionary) Trust, really?

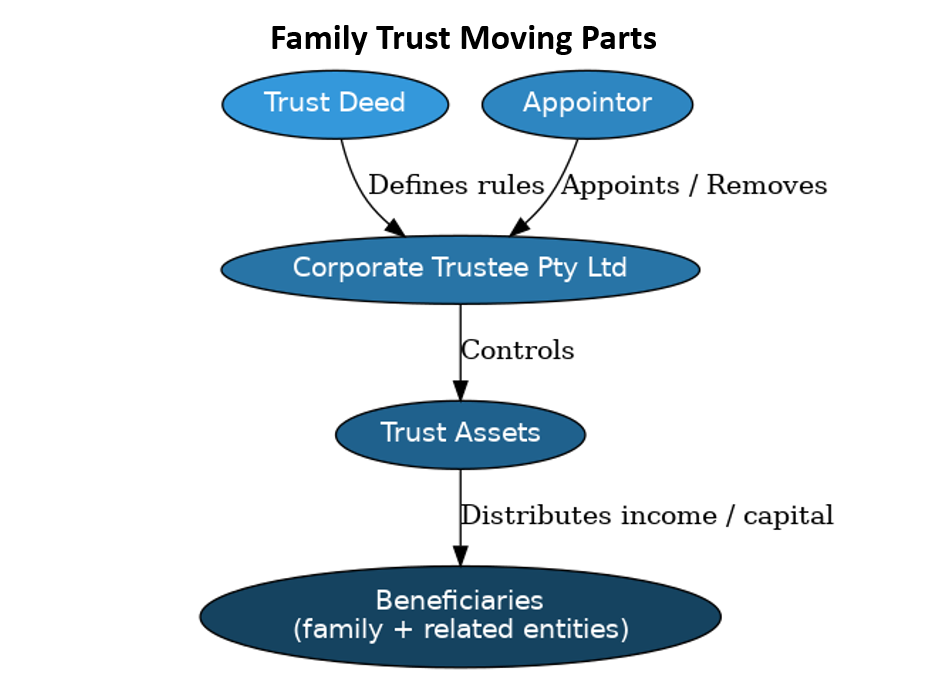

A legal relationship (not an entity) where a trustee controls assets for a beneficiary class under a trust deed. The trustee decides who gets what, and when, within the deed’s rules. That discretion is the engine of both tax flexibility and asset protection.

The moving parts at a glance

Why the appointor matters: whoever controls the appointor (or “principal”/“guardian”) ultimately controls the trust. Choose carefully and plan succession.

Who should seriously consider one?

Business owners & practice principals

- Smooth volatile income year‑to‑year by letting profits flow through the Trust to Beneficiaries.

- Keep operating risk away from personal assets for protection.

- Pay dividends from the trading structure to the trust and allocate where most effective and more importantly, when its most effective.

High‑income professionals & HNW families

- Direct investment income to lower‑tax family members (within rules) or retain in a corporate beneficiary to distribute when you need the income (bucket / Investment Company).

- Stream franked dividends efficiently (consider a Family Trust Election if relevant).

- Centralise long‑term assets and succession planning.

A Family Trust is Not ideal if you want a simple “set‑and‑forget”, to distribute to minors expecting low tax (minors face penalty rates), or you can’t maintain basic governance (minutes, resolutions, accounts) get a great accountant!

Why use one? The four big wins

1. Asset protection: Trust assets aren’t owned by beneficiaries personally. With a corporate trustee and clean governance, you reduce the blast radius of lawsuits or business failures.

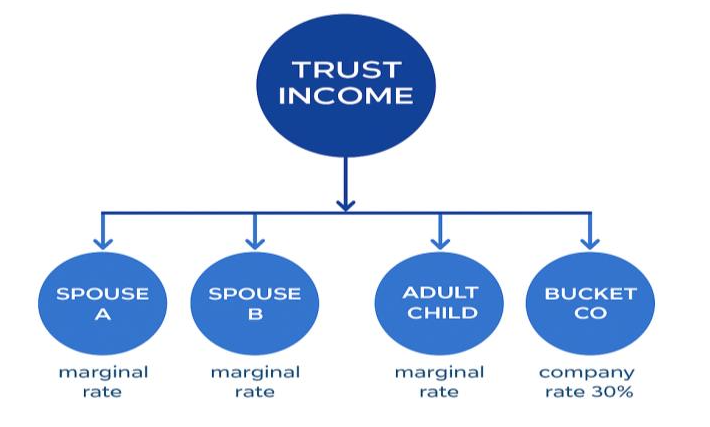

2. Tax‑flexible income distribution: Each 30 June you can allocate income across adult beneficiaries, and (if used) to a corporate beneficiary to cap tax at corporate rates or 30%.

3. Succession: You can design control to survive you: Successor directors of the trustee company and successor appointors keep the machine running for your family to benefit from the assets held.

4. Privacy & control: Distributions happen by trustee resolution; you don’t have to transfer legal title to share gains.

Caution: tax law around trusts evolves. Stay in the “green zone” with documented resolutions, actual cashflows where needed, and advice.

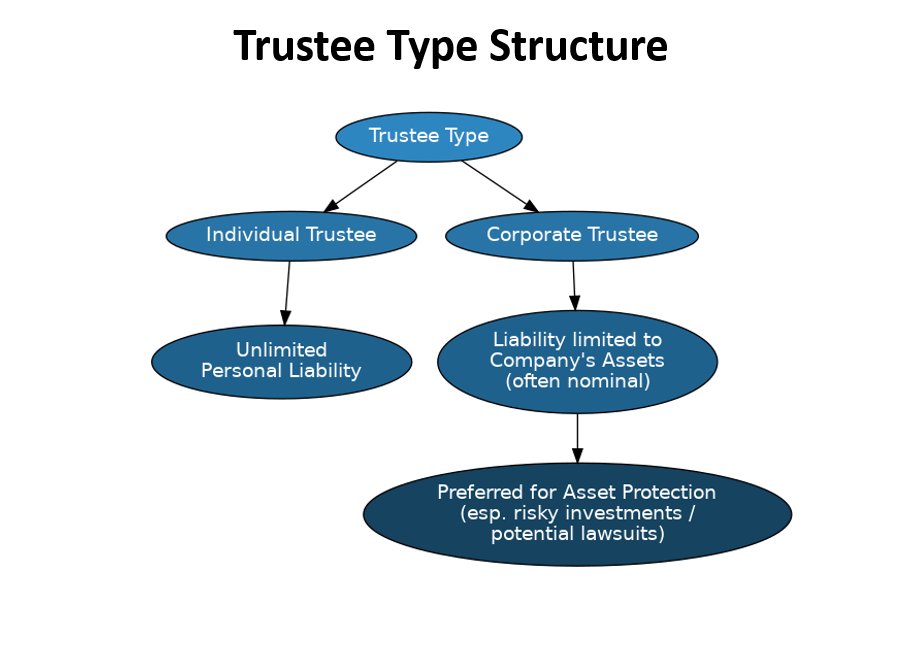

Corporate trustee vs individual trustees (Why it matters)

A family trust (discretionary) trustee is the person or entity responsible for holding legal title to the trust’s assets and managing them on behalf of the beneficiaries. The trustee has broad powers to administer the trust, make decisions about income and capital distributions, and ensure everything is done in the best interests of the beneficiaries. The trustee owes a fiduciary duty, meaning they must act honestly, diligently, and without personal conflict, always prioritising the beneficiaries. A trustee is like the manager or guardian of the family trust. They legally own and control the trust’s assets (such as property, investments, or cash) but must use them only for the benefit of the family members named as beneficiaries.

Using a company as trustee

- Limited liability: The company is on the hook first; directors manage risk, but your personal balance sheet isn’t the trust’s balance sheet. A corporate Trust should hold nothing, and its only job is to be the Trustee for the Family Trust.

- Clean succession: Directorships can change without retitling every asset. This is critically important if property is held inside the trust. (The pain of changing the names on every property title often takes years!)

- Administration: Easier banking & clearer separation of personal vs trust assets.

Naming tip: Your Family Holdings Pty Ltd as trustee for Your Family Trust (ABN for the trust; ACN for the company). Keep the company a shell (nothing in it).

Corporate beneficiary (“bucket company”): When and Why

A corporate beneficiary (often a separate company from the trustee) can receive trust distributions to cap tax at 30%. If you’re marginal tax rate is higher than 30% in makes little sense to pay the profits to yourself personally if you’re already earning over $190,000 as you will be losing 47% in every dollar.

Distribution flow (illustrative)

Key governance: if profits are appointed to the company but not actually paid, you can trigger Division 7A issues (unpaid present entitlements treated like loans). There’s fresh case law easing pressure in some scenarios, but best practice remains document, pay, or put compliant loan/sub‑trust arrangements in place to avoid surprises. Preference would be to avoid Div7a loans all together!

Why the Schedule of your trust deed is everything

The Schedule is the truth‑table of your deed. It typically lists:

- Trust name and settled sum

- Trustee (your company) and Appointor/Principal (+ successor)

- Primary/default beneficiaries and the class description (spouses, children, lineal descendants, related entities)

- Tertiary Beneficiaries (family members)

- Corporate Beneficiaries (Investment company’s and or Trusts)

- Excluded persons (e.g., the settlor) and jurisdiction

Get these wrong and you limit who you can distribute to or invite resettlement risk when trying to add people later. Get them right and you create decades of flexibility.

Who should be named?

- Appointor: the control lever (often you + spouse, or a company). Provide a successor pathway (deed or will).

- Primary beneficiaries: typically you, spouse, children, and (optionally) a class that includes future descendants. Add related trusts/companies if you plan to use them as beneficiaries.

Do not name the settlor (the person providing the $10) as a beneficiary; that breaks tax rules. Often your solicitor is the nominal settlor and then steps away.

Why many deeds are settled in Queensland (even if you live in NSW)

Stamp duty on the creation of a trust deed depends on where it’s settled and what property is settled.

- Queensland: If you settle with cash only (the standard $10), there’s no duty on creation. You typically don’t need the deed stamped.

- New South Wales: A trust over non‑dutiable/unidentified property attracts a fixed duty on establishment (assessed when lodged).

Simple comparison (creation of deed over cash only, 2025):

Jurisdiction Duty on creation (cash‑only settlement) Practical note

QLD

$0

Settle/sign in QLD; later acquisitions of dutiable property are assessed where the property is.

NSW

Fixed duty payable on

Lodge and pay within the required timeframe.

Jurisdiction

Duty on creation (cash‑only settlement)

Practical note establishment

Actionable: If your adviser/solicitor recommends it, sign the deed in QLD with a cash settlement to minimise upfront duty. Later property purchases pay normal transfer duty where the property is located. Always confirm current rules before execution.

Family Trust Election (FTE): when to tick that box

If you plan to stream franked dividends through the trust from your companies operating Profits, or you want access to trust loss rules, you may need an FTE (and sometimes an Interposed Entity Election).

Trade‑offs: You’ll nominate a test individual and effectively define your family group. That limits who you can distribute to without penalty tax, but unlocks franking and loss rules. Get advice before lodging.

The elephant in the room: resettlement risk

Changing a trust deed within its powers is common (e.g., tightening definitions, appointor succession). But adding new beneficiary classes or making changes beyond the deed’s variation power can be treated as creating a new trust, a resettlement, which may trigger CGT and duty.

Practical rules of thumb

- ·Prefer broad, well‑drafted classes from day one.

- Avoid adding beneficiaries once assets are inside the trust; if you must, get specialist legal advice and consider alternate structures.

- Keep clear records showing variations are within the deed’s powers.

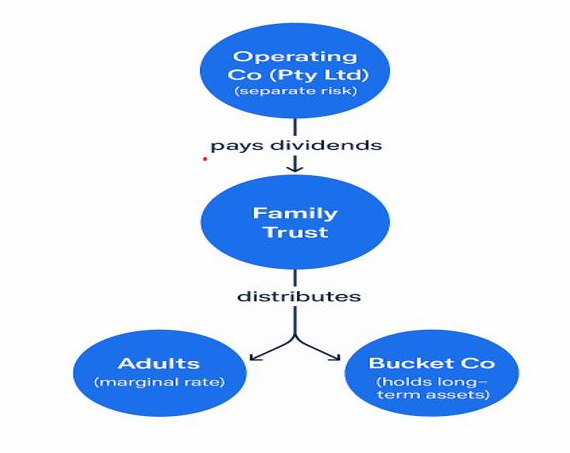

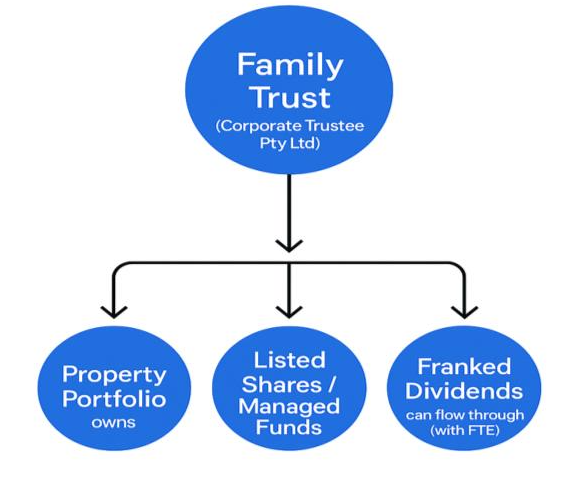

Two common structures (with diagrams)

A) Operating business with discretionary trust

Why: isolate trading risk in the company; use the trust for ownership and flexible distributions.

B) Investment trust with corporate trustee

Year‑end distribution playbook (June 30)

1. Forecast trust income by mid‑June Including all profits from company that will come through to trust plus all income from assets held by the trust.

2. Draft resolutions nominating beneficiaries and percentages/amounts if there is going to paid distributions.

3. If using a bucket company, ensure:

- It’s a named beneficiary in the deed (or within class).

- You manage cash movement (pay or document compliant loans/sub‑trusts).

4. Minute the decision by 30 June.

5. Pay distributions within the agreed timeframe.

Miss the paperwork, and the trustee can be assessed at the top marginal rate on some income. Governance beats drama.

Risks & gotchas (read this)

- Division 7A/UPEs: Company entitlements left unpaid can be treated like loans; documentation and timing matter. Recent cases may help, but policy can shift; stay conservative.

- Section 100A (reimbursement agreements): Don’t circulate income in ways the ATO considers tax‑driven. Keep distributions commercial and real.

- Minors’ tax: High penalty rates over small thresholds; trusts aren’t a magic wand for kids’ income.

- Foreign person surcharges: If any beneficiary falls into a “foreign person” definition and you hold residential land in some states, you can trigger extra duty/land tax. Get advice before acquisitions.

- Family law/bankruptcy: Trusts improve resilience, not invincibility. Control and benefit patterns are scrutinised.

Quick case study (illustrative only)

The Business Owner: Company profits swing between $500k–$1.2m. The family trust (with a corporate trustee) owns the operating company shares. Each June, profits flow to: spouse on parental leave, adult child at uni working part‑time, and a bucket company for the balance (capped at 30% company rate). Debt recycling builds a $1m portfolio inside the trust over 8 years. Governance keeps Div 7A green.

Result: lower overall tax across the family group, assets insulated from personal liability, and a clear succession plan.

FAQ

Can I add a new beneficiary later? You can vary deeds, but if you go beyond the deed’s powers or effectively create a new trust, you risk resettlement (CGT/duty). Draft broadly from day one and get legal advice before changes.

Do I need a Family Trust Election? Only if you want the benefits (franking credit streaming, loss rules). It narrows your allowable distribution group, so weigh it carefully.

Can my trust own my trading company? Yes. Common approach: trust owns shares; company runs the risk. Keep separate records.

Should my spouse be appointor too? Often yes (joint or corporate appointor), but plan for incapac

What about SA/QLD perpetuity rules? Modern reforms mean some jurisdictions allow longer trust lives. The deed can pick governing law; ask your lawyer which suits your objectives.

Prepared for general education by Tenex Wealth. This is not legal, tax, or personal financial advice.