Most people waste their 30s.

They confuse activity with progress. They build lifestyles, not wealth.

But if you play it right, your 30s will be the most financially impactful decade of your life. This decade represents the sweet spot in the wealth-building triangle: time on your side, rising income, and the wisdom to avoid costly blunders. Imagine negotiating with your future self. You hold all the leverage now. Compound interest, the eighth wonder of the world, waits to amplify every smart move. Wealth grows from a simple equation: disposable income multiplied by time, fuelled by compounding. Miss this window, and you chase catch-up forever. Seize it, and you build “fu*k you” energy, that unshakeable freedom from a paid-off home and growing assets.

In this playbook, we break it down. First, why your 30s reign supreme. Second, what assets to nail. Third, how to execute with precision. Frameworks guide every step. Examples and charts make it crystal clear. Let’s negotiate your path to prosperity.

Why Your 30s Are the Decade That Makes or Breaks You Financially

1. Stupid Mistakes

In your 20s, you didn’t know better, you try everything, listen to the pub talk or from a mate that got rich quick (luck) and you try it for yourself, to no avail. Here you’ll gain a financial scars, bad debts, credit card or After Pay experiences, or that European Summer holiday that you continued to pay off because the shots in Ibiza were worth it! No problem, chalk that one up to experience, we all need it. In your 40s, the stakes are higher, family life is paramount as you’re not just playing with your money now, it’s your families. But your 30s? This is where the wrong move haunts you for decades. In you’re 30’s you don’t Bad debt, to be Over-leveraged or to treating your home like an investment. These mistakes are recoverable, but they cost you the one resource you can’t get back TIME.

Data from the Australian Securities and Investments Commission (ASIC) shows Australians under 30 carry about 25% more consumer debt on average. Sidestep that, and your wealth sails smoothly.

2. Income Power

By your 30s you’re out of Uni or you have finished your trade, armed with experience and earning power. These are the years you start making bulk dollars. But more income also creates temptation: cars, toys, lifestyle creep. The game isn’t about how much you make, it’s about how much you keep and multiply. Average Australian salaries peak between 35-44, per ABS data, often hitting $100,000+ for professionals.

Think of income as rocket fuel. In your 20s, it’s a sputter. Now, it’s a blast. Someone earning $135,000 annually has disposable income to deploy. The equation shines: more income equals faster wealth growth.

3. Time on Your Side

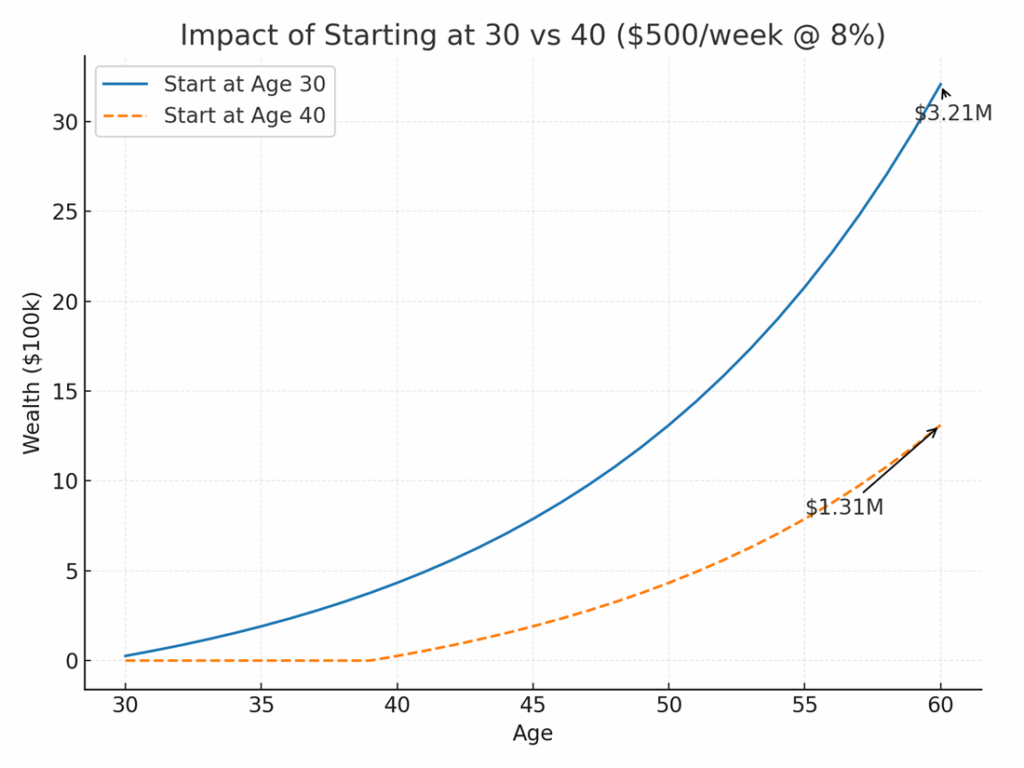

Compounding works like gravity. The longer it pulls, the stronger it gets. Start in your 30s, and you have decades of runway. Leave it until your 40s or 50s, and you’ll need to sprint with risk just to catch up (don’t do that).

What to Do: The Wealth Assets That Matter in Australia

This playbook has two parts: removing the anchors and adding the engines.

Step 1: Kill Bad Debt

Credit cards. Personal loans. Cars on finance. Boats that sink your balance sheet. These have to go completely. Zero. There’s no point investing if you’re leaking interest at 15–20% to the banks.

Your Principal Place of Residence (PPR) is the only non-deductible debt worth keeping but the faster you reduce it; the more oxygen you give your wealth.

Step 2: Build the Right Assets

Property First. (unfortunately)

In Australia, property is the lever. Our system currently is tailored towards property investors. You can leverage up to 90-95% of the property value (please don’t) in Australia. High Quality assets in great locations are the pick here. Remember the value appreciation of property predominately comes from the land. High Rise Apartment’s sold off the plan can kill your wealth building. Keep it simple, you want to get a neutrally and or positively geared property as soon as possible in an area that has rising population with some land component attached to it (think a place you would love to live with your family). Banks let you borrow against that asset, not just savings. You can’t do that with shares until much later. An investment property gives you tax-deductible debt, leverage, and exposure to an appreciating asset class. (This is not personal financial advice)

Shares Next

Once your property position is under control with leverage coming down to around 60% on a loan to value ratio, start diversifying into low-cost ETFs. This adds liquidity and reduces concentration risk. You don’t need to pay stamp duty on the way in or agent fees on the way out, you don’t have to wait 42 days after you sell to receive your money or use a solicitor to complete the transaction for you. Shares have a much lower entry value and compound at the same pace if not even quicker than property in Australia. Nobody calls you about a leaking tap, front fence that needs fixing or an air-conditioning unit that needs replacing. You don’t have to insure your shares for flood or fire damage or pay land tax each year for owning the asset.

Superannuation Always

Super is the most under-used tax strategy. A simple $50/week salary sacrifice saves someone on $135,000 over $900 a year in tax. Left inside super, earning 8% over decades, it becomes hundreds of thousands in retirement. However, in your 30’s you lose the liquidity of that money as you can’t access it for another 30 years or as rules stand today, until you are 60.

How to Execute: The 30s Playbook With Real Numbers

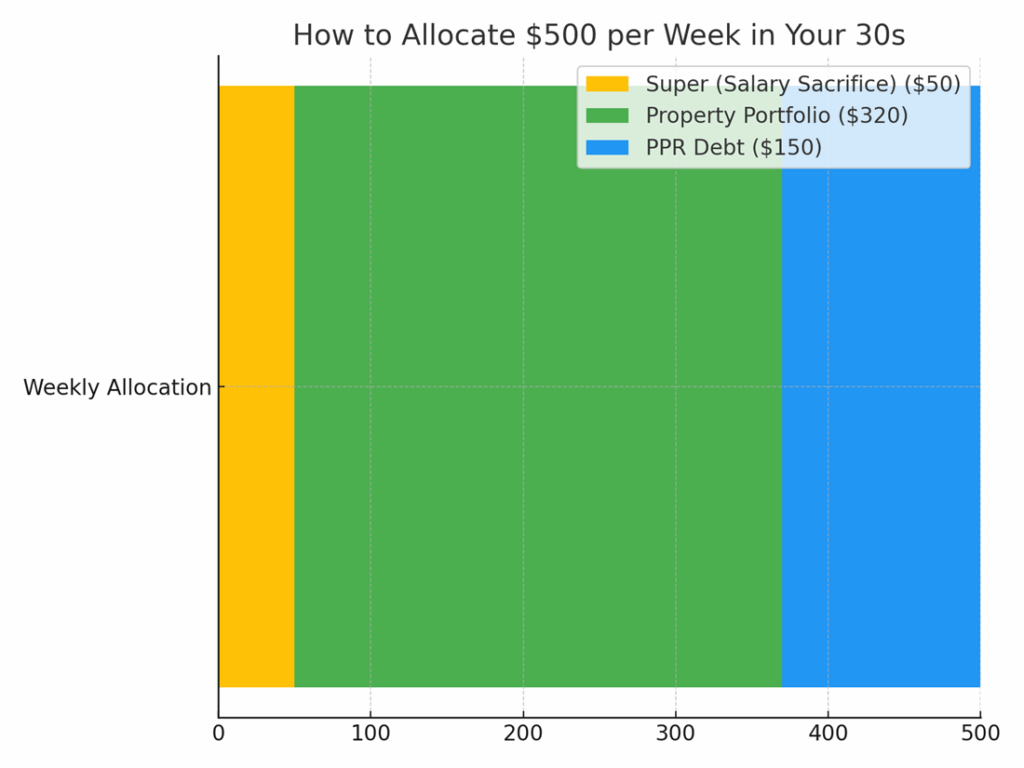

Let’s put this into practice with $500 per week in disposable income.

· $50/week into Super via Salary Sacrifice

Out of pocket roughly $30 after tax savings each week if you’re earning over $120,000 p.a. This boosts your super, reduces your tax, and locks in compounding. Critically important is that you’ll and up with over $200,000 more in your superannuation at 60. It’s not sexy, but extremely powerful because of the compounding, investing x time = freedom.

· $320/week into Property Portfolio

Use this to aggressively get onto the property ladder but once you have your first property, then use it to reduce leverage/ debt. Drive your Loan-to-Value Ratio (LVR) under 60%. Once the property funds itself (or even turns positive), you’ve secured a foundation asset. You can now let this asset do its own thing for the next 20 years. After this, you’ll own an asset that will keep pace if inflation, plus also pay you an income stream for the rest of your life (provided there is a tenant in there). Once this occurs, start an investment account with your $320 per week. Low-cost passive investing if you’re not a Morningstar analysis or Warren Buffet’s new CEO. Keep it simple, keep it automatic, and live your life. The best investing accounts are the ones you lose your password too. The phycology of leaving your investment on autopilot for a decade allows you to compound wealth without the stress of Donald Trump tweets.

· $150/week into Your Home Loan (PPR Debt)

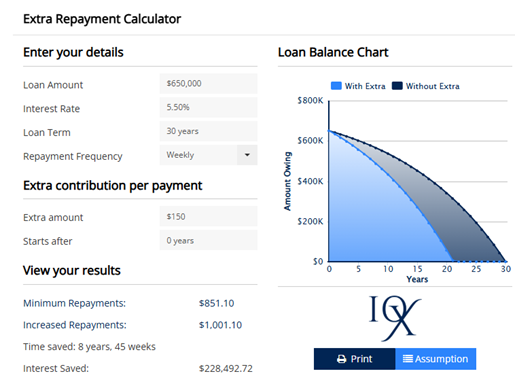

The fastest way to create “F*** You” energy is having your home paid off. No bank owns you. Every dollar after that is freedom. A home that you own allows you flexibility! Don’t like your job, change. Don’t like your boss, get a new one. Don’t like the commute to work, leave. You now have the ability to do as you please (within reason). A simple $150 per week on a $650,000 mortgage saves you about 9 years off the loan but more importantly saves you $228,000 in interest repayments.

You can calculate your own personal extra home loan repayments using my Extra Repayment Calculator.

The Leverage Rule: Smooth Seas, Not Drunken Sailors

Leverage makes millionaires, and it ruins them too. The difference is planning.

Use debt but keep cash buffers. Sail calmly, with reserves for interest rate spikes, vacancies, or market corrections. That’s how you ride out storms without capsizing. A rule of thumb I like to use personally is at least three months of your personal living expenses.

Smart leverage isn’t gambling. It’s engineering when done correctly!

Final Thought: The Decade You Can’t Afford to Waste

Your 30s decide the kind of 50s you’ll live.

Do you want the choice of working, or the obligation to keep grinding?

Play this playbook with discipline, and your 30s become the decade that sets you free. Delay it, and every future decade will be a race against time.

Financial Disclaimer – Legal Stuff

The information provided in this blog post is general in nature and does not constitute personal financial advice. It is intended for educational purposes only and does not take into account your individual financial situation, objectives, or needs. Before making any financial decisions, you should consider seeking advice from a qualified financial adviser who can provide tailored guidance based on your specific circumstances. Tenex Wealth does not guarantee the accuracy, completeness, or suitability of this information, and we are not liable for any loss or damage arising from reliance on this content.